It has been said of Quantitative Easing (QE) that every move by the Fed was priced into the markets, with reaction predicted and contained. Recent events might cast doubt on the predictability claim with financial markets mechanics maybe not functioning as well as some thought.

This post will discuss contributory factors and consider how the presence of shadow banking characteristics in the repo market could make attempts to resolve the repo crisis more difficult.

Recently Zoltan Pozsar currently at Credit Suisse and ex-senior adviser to the US Department of the Treasury, outlined three points that could have set the scene to current stress in the Repo market. These points were outlined on two separate editions of the Odd Lots podcast.

To begin, Foreign Investors like Life Insurers and pension funds seek to avoid negative interest rates in home economies and purchase US assets with attractive yields. Foreign Investors utilise the FX Swap market to hedge back to their local currency to manage FX risk and off-set costs. In 2015 when the Treasury curve was steep Foreign Investors could buy 10 Year Treasuries for 2½ %, spend 1% to hedge FX component and make a profit of 1½ %. However, in 2017 when the Fed hiked interest rates, the 10-year Treasury Yield Curve flattened reducing the 10-year yield thereby removing the ability of Foreign Investors to buy US Treasuries on a hedged basis & make positive spread.

The reduced demand for US Treasuries occurred alongside the Fed’s $600 bn taper of QE, which took reserves away from banks balance sheets. Pozsar points out it is dealers in the repo market that have difficulties with liquidity. Financial entities go to the Repo market because they cannot make payments that day. Basel III regulations require banks to maintain a Liquidity Coverage Ratio (LCR) to cover 30 days of outflows.

If Foreign Investors find hedging costs high and reduce purchase of Treasuries, dealers get backed up with Treasuries and need to lean on large banks (HQLA) portfolios. This becomes problematic if banks cannot lend as they have reached their LCR limit. It is questionable if is sustainable for only one or two large banks to be in a position to help the Repo market clear, when these banks reach their LCR, this can show as repo rates spiking at 10%.

One reason the Repo market has grown massively, is due to a new phenomenon known as Sponsored Repo, which has grown in size to $300 bn. Banks such as JP Morgan of the Fixed Income Clearing Corporation (FICC) sponsor in money funds or hedge funds and let them face off against each other through a matched book provided by the bank which can then net these positions and not use their balance sheet.

Treasury collateral coming into the system has mostly been funded through sponsored repo but this can only happen overnight as term trades are not available yet in Sponsored Repo. So Relative Value funds that need to roll their positions they can only do so overnight.

However, at the Year-end when banks have a snap shot taken of their balance sheets, no one has balance sheet to enable reserves to move around. Once dealers cannot intermediate between banks and the system there is no mechanism to inject liquidity into the repo market.

However, this isn’t to say that altering regulations is a solution. Of more relevance, is a consideration that it is the accumulation of actions and practices by the Fed, and financial markets, that have combined to create the tricky situation we have today with the repo market.

Additionally, the inability of the system to adapt and fund itself makes resolution of events such as Year-End Turn problematic if you also consider a link between the repo market and shadow banking.

The concept of shadow banking refers to an intricate system of financial interaction that occurs outside traditional banks’ balance sheets away from regulatory gaze of monitoring authorities (Palan, Nesvetailova, 2013).

It has been said collateral exchanged in the repo market can become a form of privately created money, potentially a critical part of the shadow banking system. Collateral is sold to a financial entity, which agrees to purchase the assets at a future date at an increased price. The selling entity ‘borrows’ the money, with the price difference being the same as the interest rate.

Collateral can also pass between institutions, in a chain. A repo transaction provides one institution with cash and another with securities. The institution that gets the securities, reprocesses these assets as collateral to access their own repo loans. The next repo lender can then re-use these same assets to access collateral on a loan themselves. This process is known as rehypothecation.

The process described could be said to illustrate the description of shadow banking which involves credit intermediation in networks that function as complex webs without recognised institutional structures.

Should this type of structure exist in the repo market, if concern arises about the leverage of a non-bank entity this could be problematic, as it could be difficult to identify a single source of risk or plug a funding gap without causing wider contagion. Concern is expressed by the DiMartino Booth, Chief Strategist at Quill Intelligence about a future credit event. DiMartino Booth says until the Fed is faced with such a credit event, it will claim it is just solving technical glitches in the Repo market.

Therefore the Feds continuing market interventions to counter spikes in the repo market or continuing purchase of US Treasuries to build up reserves, could obscure hidden fault lines and connections. This concept borrows from Normal Accident Theory which claims if parts in a machine are altered, adjustments become problematic as machine function cannot accommodate the modified nodes. The accumulation of actions by the Fed and the actions of entities in financial markets may require a more in-depth approach instead of the outside looking in approach adopted by Central banks so far with QE.

Perspectives on Repo Market

Since Repo rates spiked on 16th September, the US Federal Reserve has pumped upwards of $500 bn into the Repo market. However, any discussion about Repo seems a bit like looking at a twig in a river, a different perspective can be had depending on the angle you look from.

Discussion since rates spiked on September 16th has included the characteristics of repo, banks LCR ratios and what this technically means regarding their engagement in the repo market. The position of dealers in terms of liquidity and possession of treasuries/collateral and sponsored repo, the players involved and what the rules enable actors to do.

But these aspects although crucial to understanding the market, don’t really explain the full picture. Repo is a useful tool, a mechanism financial entities can use, but if it does not prove useful, it can be circumvented or disregarded and other transactions can be utilised, such as Total Return Swaps (TRS) employed by Goldman. The bank sought to replicate repo with TRS which reduce the capital standards required for straightforward trading in repo. Goldman deployed TRS to exchange a return from US Treasuries between itself and Hedge Funds. One entity makes payments based on a set rate while the other party makes returns based on the total return of the underlying Treasury.

The utilisisation of TRS by Goldman raises the question of whether Repo itself, what it is and how it functions should be the focus or whether the activities of financial entities within and outside repo that should be of interest. A mechanical approach that seeks to *fix* repo doesn’t begin to analyse the different angles and depths of entities transactions and funding needs.

If we briefly consider two theories. The first one being Complexity Theory, as argued by Anderson. This asserts the decisions of economic entities are determined by a cognitive function which determines behaviour from a set of rules. Order is seen in complex situations which is useful for considering how financial entities might adapt in complex environments. The second theory is a model conceived by this blog, The Financial Innovation Model (FIM). The FIM possesses a rational maximizing function which ultilises and manipulates financial markets. A self-interest function evolves to prevent regulatory or institutional limits obstructing the pursuit of goals.

Complexity theory might consider the approach of the Financial Stability Board in 2012 which advocated applying numerical floors on haircuts at a transactions level for Security against Cash Transactions. It is suggested that regarding TRS, proposed haircuts should take into account proposed haircut schedules for non-centrally cleared derivatives when formulating numerical floors for Security against Cash Transactions.

However, whilst it is useful to examine detailed transaction types and risk areas, the FIM would liken this approach to trying to catch a deluge in a paper cup. There are so many transactions and the structures, and the features of shadow banking are complex and multi layered. Opportunities are always present to evade and manoeuvre to securitise and intermediate to gain value from collateral. However, such processes can create complex, fragile feedback loops. Arbitrage and innovation are different processes that are intrinsic to financial markets. In regards to repo, rather than Treasuries being an asset dealers got backed up with, they seem to have become a new opportunity to evade regulation and enhance potential for gain.

This makes suggestions that the Fed effectively establish a standing repo facility as rather besides the point. Does this mean it oversees a market that might have outlived its usefulness, whilst failing to comprehend potentially damaging activities on the margins. JP Morgan’s use of Sponsored Repo might circumvent Liquidity Capital Ratios and make transactions nettable, but this could create problems as Sponsored Repo is only available overnight, so should a Hedge Fund need to roll a position they can only do this overnight, if dealers don’t have balance sheet, there might not be liquidity available.

Hedge Funds have also utilised an innovation that exploits differences between comparable securities in the Treasuries market. Relative Value Trading uses price differences between two almost identical assets. A Hedge Fund would buy Treasuries and sell a derivative contract like interest rate futures and extract a small price difference. To make this worthwhile, to compensate for the small price difference, the Treasury that is purchased, is bought and exchanged in the repo market for more cash which is used to improve the trade and duplicated to build up leverage and increase returns. It is said to fuel this trade, Hedge Funds submitted increased demands for cash in September which contributed to September’s repo rate spike. Trades that hinged on the ability to secure large amounts of cash from banks became problematic when the supply ran out.

To go back to the earlier analogy, solutions to the repo madness have seemed to stay on the bank of the river looking from one angle, claiming to know how things work. Utilising this approach many months later, we are no closer to gaining an understanding.

Rather than looking at repo as a market in isolation, it might be more useful to examine the complex web of non-bank entities engaged in structures that seek to carry out off-balance sheet credit intermediation, maturity and liquidity transformation in capital and money markets. It is these processes that drive needs for funding, the actions and consequences of which then transmit into financial markets. Repo is simply the twig at the surface of the river, the layers and depths underneath are what sustain and redefine the many angles it represents

Zombie Companies

In its introduction, this blog outlined the assertion that actions and consequences can transmit through hidden connections and potential fault lines in financial markets. To consider the validity of this assertion, this post is the first in a series to look at the Corporate Bond Market. The intention is to discuss each aspect of this market in detail to consider the characteristics before considering the wider assertion regarding connecting elements and fragilities. To begin, this post will consider the concept of Zombie Companies.

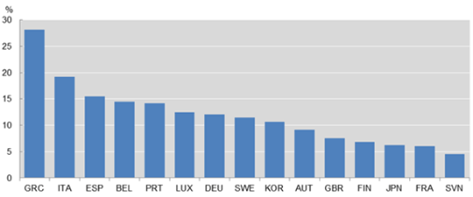

So called Zombie companies are defined by the OECD as low-productivity companies that continue operating even though in a normally functioning market they would cease trading. McGowan et al, define Zombie companies as firms established for 10 years or more, with an interest coverage ratio of minus one over three consecutive years. Data which goes up to 2013 shows the distribution of Zombie companies across a number of OECD Countries.

Share of capital sunk in zombie firms in 2013

Note: Zombie firms are defined as firms aged ≥10 years and with an interest coverage ratio<1 over three consecutive years.

Source: Adalet McGowan, Andrews and Millot (2017), based on ORBIS data.

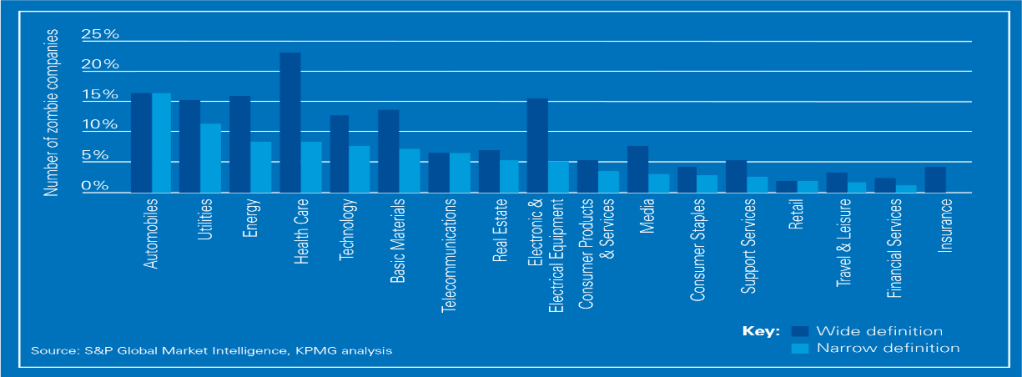

McGowan et al, found that for the UK, the figure for capital stuck in Zombie companies remained at around 7.5% between 2010 and 2013. More recently, data from KPMG has described the number of Zombie companies in the UK as between 8% and 14% in 2018 depending on two definitions, the Interest Coverage Ratio (the Wide Definition) and the Tobin Q definition (the Narrow Definition). The Tobin’s Q ratio is derived from the market value of a company divided by the replacement value of a firm’s assets. Using these definitions, KPMG also broke the figures for Zombie companies, down specific sectors in the economy.

Concentration of listed zombie firms among UK sectors

The wide definition in the chart departs from the data for the narrow definition, most noticeably in the Healthcare, Energy and Electronic and Electrical equipment sectors. The automobile sector shows the biggest alignment between both definitions.

Regarding the wider manufacturing sector in the UK, the British Chambers of Commerce BCC Economic Survey of Q3 2019, surveyed 6,600 UK firms employing 1.2 million people. The survey revealed found that firms reporting an increase in domestic orders fell from +4% in Q2 2019 to -7%. The balance of firms reporting improved cash flow fell into negative figures, from +2 to -7%, it is claimed this is the weakest outlook since Q3 2011. In the service sector, firms reporting an increase in sales fell from +17% in Q2 2019 to +15%. Domestic orders fell from +10% to +9%. Report of improved cash flow remained at +5%.

These figures can only give a brief snapshot of the potential health or strength of companies in particular sectors and as KPMG acknowledge, a low interest cover ratio may not automatically indicate a company possesses Zombie tendencies. However, this brief introduction can serve as a framework in which to begin to place in context the common definition of Zombie companies as firms that cannot meet costs of paying off debts from current company profits.

The next post in this series on Corporate Bonds will look in more detail for the reasons firms are unable to meet costs of debt and the extent to which companies are highly leveraged and the reasons for this leverage.