In its introduction, this blog outlined the assertion that actions and consequences can transmit through hidden connections and potential fault lines in financial markets. To consider the validity of this assertion, this post is the first in a series to look at the Corporate Bond Market. The intention is to discuss each aspect of this market in detail to consider the characteristics before considering the wider assertion regarding connecting elements and fragilities. To begin, this post will consider the concept of Zombie Companies.

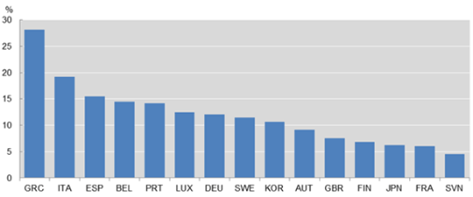

So called Zombie companies are defined by the OECD as low-productivity companies that continue operating even though in a normally functioning market they would cease trading. McGowan et al, define Zombie companies as firms established for 10 years or more, with an interest coverage ratio of minus one over three consecutive years. Data which goes up to 2013 shows the distribution of Zombie companies across a number of OECD Countries.

Share of capital sunk in zombie firms in 2013

Note: Zombie firms are defined as firms aged ≥10 years and with an interest coverage ratio<1 over three consecutive years.

Source: Adalet McGowan, Andrews and Millot (2017), based on ORBIS data.

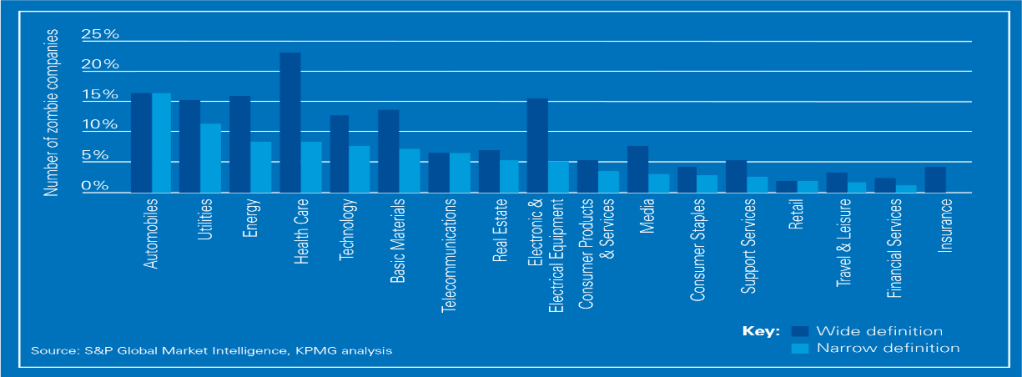

McGowan et al, found that for the UK, the figure for capital stuck in Zombie companies remained at around 7.5% between 2010 and 2013. More recently, data from KPMG has described the number of Zombie companies in the UK as between 8% and 14% in 2018 depending on two definitions, the Interest Coverage Ratio (the Wide Definition) and the Tobin Q definition (the Narrow Definition). The Tobin’s Q ratio is derived from the market value of a company divided by the replacement value of a firm’s assets. Using these definitions, KPMG also broke the figures for Zombie companies, down specific sectors in the economy.

Concentration of listed zombie firms among UK sectors

The wide definition in the chart departs from the data for the narrow definition, most noticeably in the Healthcare, Energy and Electronic and Electrical equipment sectors. The automobile sector shows the biggest alignment between both definitions.

Regarding the wider manufacturing sector in the UK, the British Chambers of Commerce BCC Economic Survey of Q3 2019, surveyed 6,600 UK firms employing 1.2 million people. The survey revealed found that firms reporting an increase in domestic orders fell from +4% in Q2 2019 to -7%. The balance of firms reporting improved cash flow fell into negative figures, from +2 to -7%, it is claimed this is the weakest outlook since Q3 2011. In the service sector, firms reporting an increase in sales fell from +17% in Q2 2019 to +15%. Domestic orders fell from +10% to +9%. Report of improved cash flow remained at +5%.

These figures can only give a brief snapshot of the potential health or strength of companies in particular sectors and as KPMG acknowledge, a low interest cover ratio may not automatically indicate a company possesses Zombie tendencies. However, this brief introduction can serve as a framework in which to begin to place in context the common definition of Zombie companies as firms that cannot meet costs of paying off debts from current company profits.

The next post in this series on Corporate Bonds will look in more detail for the reasons firms are unable to meet costs of debt and the extent to which companies are highly leveraged and the reasons for this leverage.